OFE Programs & Projects

CollegeBound Saint Paul

CollegeBound Saint Paul provides every baby living in the city of Saint Paul starting on January 1, 2020 a college savings account opened with $50.

Contact: collegebound@ci.stpaul.mn.us or 651-266-8829.

Guaranteed Income

The City of Saint Paul launched the People’s Prosperity Pilot in 2020 and CollegeBound Boost in 2022 to give randomly selected CollegeBound Saint Paul families with a $500 unrestricted monthly cash transfers for 18 and 24 months, respectively. The additional income helps families make ends meet and the dignity to have control over their decisions. Participating CollegeBound children also receive additional deposits in their college savings accounts. This initiative is part of a larger national network called Mayors for a Guaranteed Income.

Contact: Prosperity@ci.stpaul.mn.us or 651-266-8829.

Learn more about guaranteed income

Fair Housing

Fair Housing goals include increasing housing access; decreasing housing displacement; and affirmatively furthering fair housing.

Learn more about Fair Housing resources

LOCAL Fund

To address the impacts of the pandemic on Saint Paul’s communities and small businesses, and as part of a Citywide strategy to build institutional commitment to community wealth building, the City of Saint Paul created the LOCAL Fund to use a shared ownership model to achieve healthy and sustainable neighborhoods through recovery of vacant and abandoned properties and to mitigate the enduring economic impacts of the pandemic on small businesses. The LOCAL Fund is a partnership with Nexus Community Partners.

Learn more about the LOCAL Fund

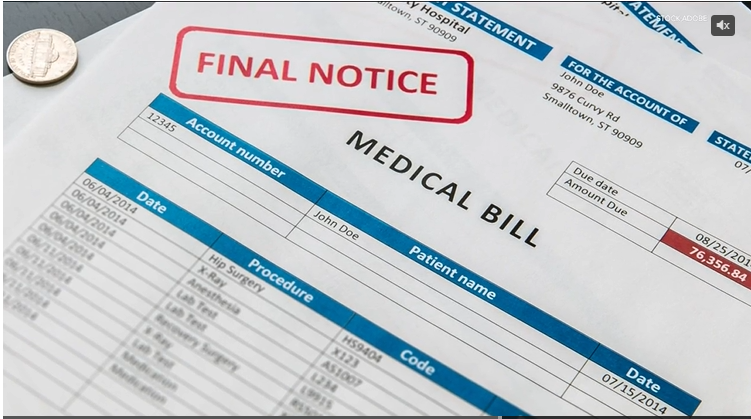

Medical Debt Reset Initiative

The City of Saint Paul is using American Rescue Plan funds to cancel an estimated $110 million in medical debt for Saint Paul residents.

Learn more about the Medical Debt Reset Initiative

Returning Home Saint Paul: A Beyond Backgrounds Program

Returning Home Saint Paul increases housing access for residents returning to Saint Paul from incarceration. This is a partnership with Housing Link and Ujamaa Place. The program launched in November 2020.

Learn more about Returning Home Saint Paul

Fraudulent Immigration Services Campaign

In partnership with the Immigrant and Refugee Program in the City Attorney’s Office, OFE is launching the Fraudulent Immigration Services Campaign, which will provide Saint Paul community members with information on immigration scams. This awareness campaign is financially supported by the Local Consumer Financial Protection Initiative at the Cities for Financial Empowerment Fund.