Compliance and Recertification Submissions

To retain the tax benefitted 4d/LIRC status, property owners must annually submit a compliance form (aka the recertification form) to the City of Saint Paul and submit a reapplication form to Minnesota Housing.

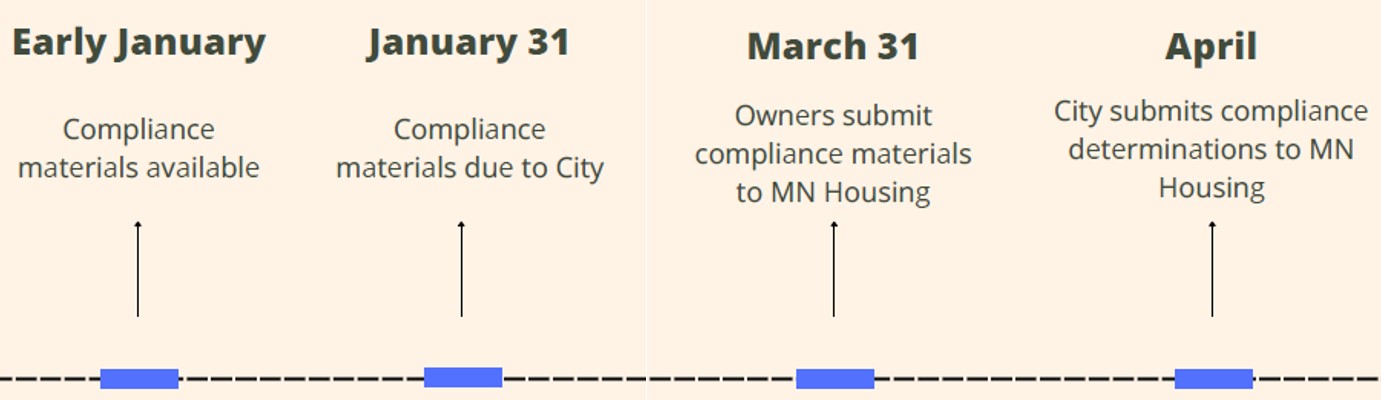

The yearly recertification forms used to capture this information are available in January. Property owners are required to submit TWO forms each year.

Please use the Compliance and Recertification Checklist as a guide and refer to the income and rent limits below.

City of Saint Paul

After your property is enrolled in the 4d program, you must complete an annual report to confirm the property is still meeting the requirements. Without this “Recertification”, your property will not receive the tax benefit until requirements are met again.

Property owners must fill out the City of Saint Paul 4d Recertification Form and submit to 4d staff by January 31 each year.

Minnesota Housing

While the initial application to Minnesota Housing is covered by the City of Saint Paul upon acceptance and enrollment into the 4d Program, property owners must complete and mail their LIRC Renewal form annually with accompanying fee to Minnesota Housing. This step is required by Minnesota Housing to confirm your property’s LIRC status.

The fee is $10 per 4d unit, up to a maximum fee of $150 per property.

Please mail LIRC renewal forms by March 31 to:

ATTN: LIRC

400 Wabasha Street North

Suite 400

Saint Paul, MN 55102

Note: LIRC renewal forms are updated around January every year and can be found on Minnesota Housing’s LIRC Program webpage.