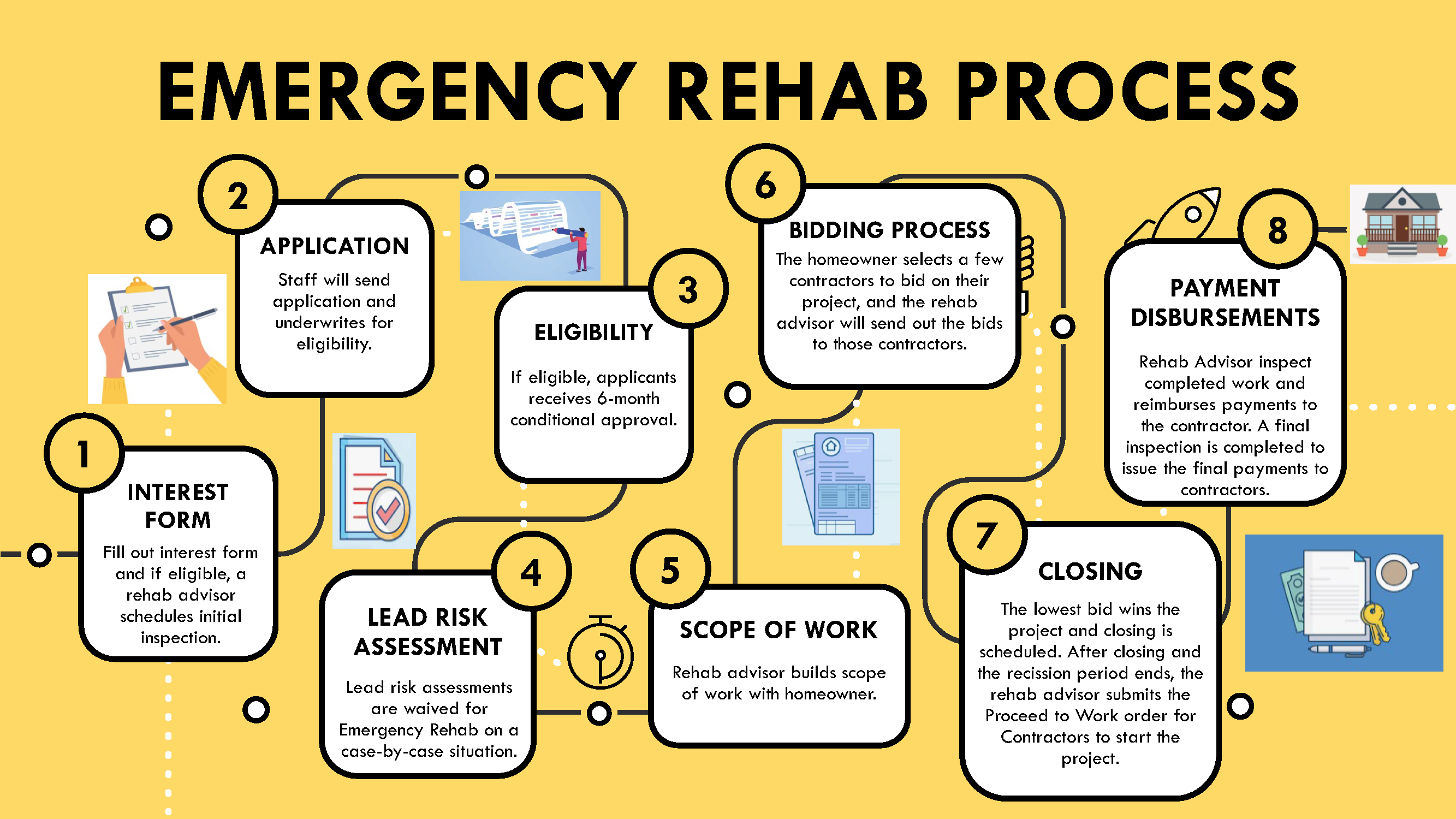

Overview

This program offers homeowners no-interest deferred loans for emergency improvements to homes located in the City of Saint Paul.

Qualified homeowners can receive between $5,000 and $40,000 for emergency repairs. Once funding is secured, the City of Saint Paul disburses the payments to the contractors when the project is complete.