What is the Minimum Wage Ordinance?

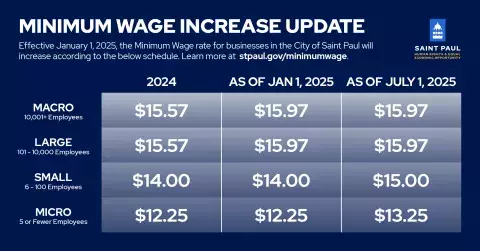

The Minimum Wage Ordinance sets the lowest hourly pay rate for work done in the City of Saint Paul. Minimum Wage requirements vary based on a business's size. The City will require businesses of all sizes to pay their employees a minimum wage of $15 an hour by 2027.

- Wages include salary, hourly pay, piece rate pay, commissions, and non-discretionary performance bonuses. Employer payments toward medical benefits and tips are not considered wages.

- Employers must keep track of where their employees are working. Records can include (but are not limited to) delivery addresses, estimated travel times, historical averages, dispatch logs, scheduling logs, and appointment details.

- Looking for information in Hmong? Watch this Hmong-language video created in partnership with 3HmongTV and Councilmember Nelsie Yang.

Contractors and subcontractors performing work for the City may be required to pay their workers the City's Prevailing Wage or Living Wage.

Minimum Wage Ordinance Prevailing Wage and Living Wage Ordinances

Who does the ordinance cover?

The ordinance covers all employees performing work in the City of Saint Paul. Employees must perform at least two hours of work in Saint Paul in one week to be owed the minimum wage.

- Full-time, part-time, temporary, and paid on-call employees are all covered under the ordinance.

- Immigration status does not impact coverage of the Minimum Wage Ordinance. The City's Department of Human Rights and Equal Economic Opportunity (HREEO) enforces the Minimum Wage ordinance. HREEO does not ask for an employee’s immigration status when an employee reaches out with a question or files a complaint. It is illegal for an employer to suggest that they will report immigration status if an employee complains.

- The ordinance does not cover independent contractors or individuals in the Minnesota Extended Employment Program. It also does not cover people with disabilities who receive licensed home- and community-based services, if their employment receives intensive support services.