Medical Debt Reset Initiative

Erasing Medical Debt for Residents

The City of Saint Paul is using American Rescue Plan funds to cancel an estimated $110 million in medical debt for Saint Paul residents.

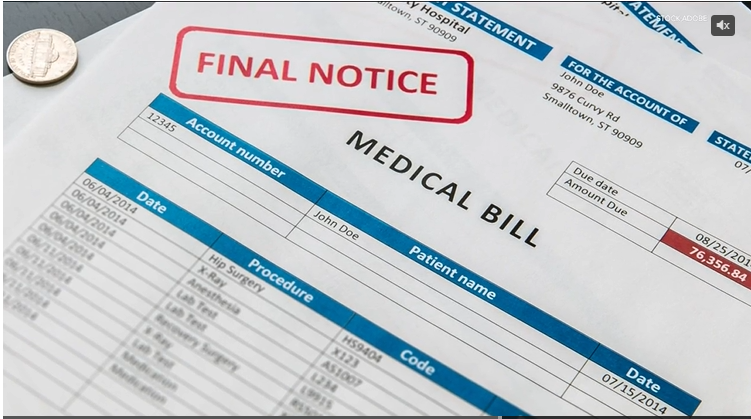

Medical debt poses a large financial burden for many individuals and families. People with medical debt often report delaying medical care, experiencing depression and/or anxiety, losing their home, or declaring bankruptcy due to medical bills. By easing the burden of medical debt, the City of Saint Paul's Medical Debt Reset Initiative helps residents build health and wealth in their communities.

How It Works

The City of Saint Paul is partnering with Undue Medical Debt, a national, independent nonprofit organization, to acquire and cancel medical debt from local health systems. Undue Medical Debt buys large medical debt portfolios from health systems at a steep discount and erases them. On average, $1 relieves $100 of face value medical debt. The City can therefore use $1.1 million in American Rescue Plan funds to erase an estimated $110 million in medical debt for qualifying Saint Paul residents.

If you have outstanding medical debt, here's what to know about the initiative:

- There is no way to apply for this program. Undue Medical Debt will work directly with local health systems to acquire debt portfolios and analyze the data to identify qualifying accounts. All qualifying accounts will have their debt canceled.

- You'll be notified if your debt is cancelled. You'll receive a letter or email letting you know what specific debts have been canceled. Debt cancelation does not lead to income tax liabilities, penalties or strings attached for program recipients. There is no guarantee of future medical debt relief.

- Health systems will share certain information with Undue Medical Debt to get a patient's debt cancelled. This includes demographics, insurance, dates of service, amount owed, and other information to identify which patients qualify for debt cancellation based on income. All data sharing is HIPAA compliant and does not include personal health information.

Eligibility Guidelines

To be eligible for the Medical Debt Reset Initiative, recipients must be:

- residents of Saint Paul

- Have income between 0 to 400% of the Federal Poverty Guidelines, or

- Have a medical debt representing 5% or more of their annual household income.

The Medical Debt Rest Initiative can only cancel medical debts if health systems sell or donate debt portfolios to Undue Medical Debt. Medical debt relief is provided out of the blue by mail to qualifying residents and cannot be requested.

Benefit to Health Systems

Any health system serving Saint Paul is welcome to participate in the Medical Debt Reset Initiative. Health systems benefit from this program by selling otherwise uncollectible debt. Undue Medical Debt uses a standard, competitive pricing model comparable to the fair market value of qualifying medical debts. Providers are then able to reinvest this money into operations and patient care.

Questions?

For more information about the Initiative, you can contact the Office of Financial Empowerment at ofe@ci.stpaul.mn.us or 651-266-8680.

Mayor Carter Announces Nearly $40 Million of Medical Debt Abolished for 32,000 Saint Paul Residents

On November 12, Mayor Carter announced that the City of Saint Paul and Undue Medical Debt abolished nearly $40 million of medical debt for 32,000 Saint Paul residents. In partnership with national, independent nonprofit Undue Medical Debt. The debt has been purchased from Fairview Health Services and is the first relief package of Mayor Carter’s Medical Debt Reset Initiative.

Medical Debt Reset Initiative in the News

Fox 9: St. Paul wipes out nearly $40 million in medical debt for 32K residents

St. Paul Mayor Melvin Carter announced on Tuesday that thousands of city residents are getting nearly $40 million of medical debt wiped out.

Next City: I’m the Mayor of St. Paul. Here’s How Our City Is Erasing $100 Million in Medical Debt.

Op-ed: More and more local governments are using federal funds to relieve residents’ medical debt. It’s a simple, straightforward way to meet our communities’ needs.

Pioneer Press: Medical debt relief in St. Paul: How will it work?

Working through at least a handful of hospitals and health care providers, St. Paul is poised next year to cancel out $110 million in hard-to-collect medical debt held by some 43,000 city residents, a first for Minnesota.

MPR: St. Paul mayor Melvin Carter on the city's medical debt cancellation plan

St. Paul City Council has approved a budget for next year.The budget funnels $1 million in leftover pandemic relief money from the federal government to a non-profit firm that will help residents who are saddled with medical debt.

KARE 11: St. Paul City Council approves millions in relief for residents experiencing medical debt

Mayor Melvin Carter said he learned about this approach to ease the burden of medical debt on residents by researching what other cities were doing.

Pioneer Press: Real World Economics: St. Paul’s medical debt plan makes sense, despite the tradeoffs

At times issues that are minor and short-term in themselves can illuminate broader tradeoffs or principles. That is true for the mayor and city council of St. Paul choosing to spend $1.1 million to wipe out city residents’ unpaid debt to medical providers worth a nominal value of over $100 million. This will benefit some 43,000 city residents, improving their credit and thus their access to modern payment systems and to needed services.